A YEAR OF TRANSITION AND TRANSFORMATION

2018 was a year of strategic realignment by Basic Energy Services to accelerate profitability and increase free cash flow. Today, we are a company more geared to production services than at any time in our history, with notable increases in bundled services and the volumes of piped water Basic delivered to our saltwater disposal (SWD) network throughout the year.

Our breadth of service offerings enabled Basic to respond quickly to weaker completion services demand and pricing in the markets when oil prices fell mid-year. We redeployed assets into higher demand geographic markets where production volumes are continuing their steady climb.

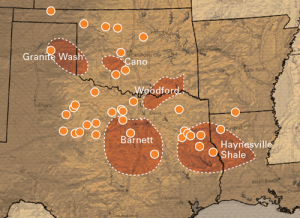

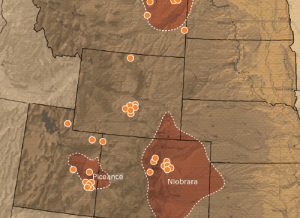

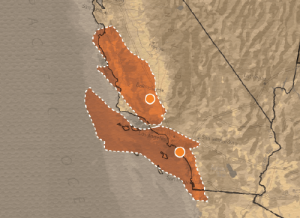

Basic exited non-core businesses, including our mining and construction operations in La Barge, Wyoming, which we divested in October. We relocated assets away from natural gas-focused regions, fully exiting the Marcellus Shale and San Juan Basin, and we do not expect to return to these basins until natural gas prices recover and longer-term market outlooks are more favorable.

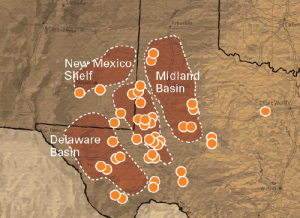

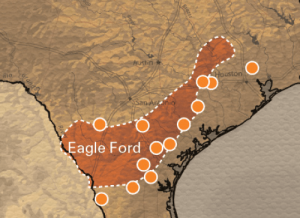

We also relocated assets to operating areas where our customer base is most active. We transferred rental tools, water trucks and well servicing rigs from regions that have yet to recover from the downturn to core markets where Basic holds market-leading positions, namely, the Permian Basin in West Texas and Eastern New Mexico, the SCOOP/STACK in our Mid-Continent Region and the Eagle Ford Shale in South Texas. We also moved frac pumping assets from the Permian Basin to the Mid-Continent where Basic’s operating scale and broader customer base drove higher utilization rates.

Our customers reacted favorably to these adjustments, making Basic the most utilized well servicing company in the U.S. and one of the country’s leading saltwater disposal companies.

As a result, our cash flow generation from well servicing, water logistics, and rental and fishing tools became more central to the Company’s overall success while pumping services continued to shrink as a portfolio segment for Basic.

Basic made significant financial adjustments during the year. The Company completed a refinancing in October of 2018 that included a five-year bond and revolving credit facility which created significantly greater liquidity. We finished 2018 with better revenue and EBITDA performance, a more concentrated geographic footprint to drive free cash flow, and a more suitable capital structure to support our future business plans.

PUTTING SAFETY AND OUR PEOPLE FIRST

The safety of our people, our customers and the communities in which we operate remains our highest priority. In an environment marked by increasing man hours, miles driven by employees and the onboarding of many new hires that have never worked in our industry, Basic strived to maintain one of the safest businesses in the industry.

Labor remains a constraint in most of our markets, a challenge for the entire industry, particularly considering low unemployment rates across the country. Basic continues to be a leader in recruiting and retaining top talent, and the Company added experienced team members throughout the organization during the year.

WELL SERVICING

Basic Energy Services maintains a comprehensive fleet of well servicing equipment with a multitude of capabilities to best serve our customers’ needs, especially for complex, long lateral horizontal wells. We led the nation for well servicing rig utilization throughout 2018. This was driven in part by demand for our high-spec 24-hour workover packages, with that demand up by more than 40 percent over 2017 and remaining stable throughout the year.

Long lateral horizontal wells remain at the heart of new exploration and development drilling techniques across the industry. Basic has bundled our high-spec rigs, large horsepower pumps and power-swivels along with other rental equipment to support large and complex workover and completion operations. We expect sustained demand for our well servicing fleet throughout 2019 and beyond to serve operations in these types of projects, particularly as operators focus on maintenance of their existing and new production.

Conventional plays still hold meaningful returns for our customers and we continue to provide maintenance and workover services in these basins.

WATER LOGISTICS

With every barrel of oil produced in today’s oilfield, approximately four barrels of residual saltwater are also produced and require a means of disposal. Basic is one of the country’s largest water logistics companies operating in the oilfield, and we are quickly becoming one of its largest operators of saltwater disposal wells. We nearly doubled our piped volumes from the fourth quarter of last year to the fourth quarter of 2018 with over three million barrels as the industry transitions to cope with the ever-increasing volumes of disposal water. This increase was deliberate in our strategy, and our capital investment plan in the future is focused on additional opportunities to expand this business to meet market demand.

The Permian Basin is now producing almost four million barrels of oil per day with expectations of reaching five million barrels in a few years. We continued to respond to the dramatic increase in the amount of water produced with every barrel of oil by working with our customers to build the infrastructure required to create and maintain efficiencies that drive down lifting costs. Some of our customers have experienced delays due to a lack of water disposal infrastructure. These market forces are informing our investment plan going forward. We are taking all the necessary steps required to maximize water volumes.

This continued increase in oil production in the United States presents a significant opportunity for Basic to participate in recurring, long-term steady revenue. We are responding accordingly and are focused on every aspect of the water disposal value chain.

We expect to be a leader in the build-out of this water disposal infrastructure, which is a higher margin business with lower maintenance and labor intensity than other forms of disposal transit including trucking.

Given the everyday logistical challenges of our customers and continuing new production completion activity, demand for our trucks has been steady and consistent throughout the year; and our fleet continues to be a great bridge to additional opportunity as customers migrate to moving produced-barrels to our SWDs by pipeline. The Basic trucking fleet still handled more than 51,616,000 barrels of produced water in 2018. In addition, we still truck fresh water for drilling and completion operations, and we still truck flowback water upon the initial frac of the well. These services remain a requirement. However, the most efficient method of disposal of residual produced saltwater is via pipeline, and we expect this midstream-type of business model to be an increasingly important part of our water logistics business.

COMPLETION AND REMEDIAL SERVICES

The Company’s coiled-tubing, cementing, acidizing and snubbing services were all stable businesses throughout the year. The fracturing market was inundated with excess pumping horsepower throughout the year as the supply of new and reactivated equipment outpaced demand, weakening pricing and utilization across this sector. Basic will maintain our frac capacity at current levels as growth in this segment is not core to the Company’s production services focused strategy.

However, Basic’s rental and fishing tools (“RAFT”) benefited from the steady demand for 24-hour packages and workover jobs. Equipment rentals associated with completions and larger workovers can double or triple the overall revenue potential for this equipment. Rental tools that enhance high-spec heavy-duty workover and completion operations will remain an area of opportunity as we outfit more of our well service rigs with a complement of rental equipment.

MOVING FORWARD

Based on current crude oil pricing and customer discipline for free cash flow, we expect the domestic oil and gas market to remain generally flat throughout 2019 compared with 2018. Basic will continue to shift our focus to production-oriented services that will benefit from gradually increasing U.S. oil production volumes and maintenance intensity. These production-oriented services are driven by customers that are focused on reducing their operating expenses and enhancing production in the most efficient use of capital.

We are focused on pursuing actions to enhance our cash flow, protect our liquidity and de-lever the Company’s balance sheet. Our capital investment plan is also focused on long-lived assets that generate long-term durable revenue streams that require lower maintenance capital expenditures and enhance value.

We believe that returning the Company to the financial results prior to the industry downturn of 2015 will require industry consolidation. Our management team and organization have significant experience in this area, and we are poised to execute de-levering transactions over the current year and beyond. Our balance sheet is strong with the enhanced liquidity necessary to enable us to invest in our midstream water disposal network and maintain our valuable fleet of high-spec workover rigs and our other valuable assets.

THANK YOU

I would like to thank our entire team who worked diligently to take the necessary steps throughout the year to strengthen Basic and to position the Company to meet the needs of a market in transition. Basic’s proven management team, local field leadership and all of our employees continue to distinguish the Company and we are all working to build a better Basic in the future.

I would also like to thank our customers, shareholders and the Board of Directors for your continued trust and support.

Sincerely,

T.M. “Roe” Patterson

President and Chief Executive Officer