- United States

- /

- Insurance

- /

- NasdaqGM:YB

Undiscovered Gems in the US Market for September 2025

Reviewed by Simply Wall St

As the U.S. market experiences a slight downturn following record highs, attention is turning to potential interest rate cuts amid weak job growth and declining Treasury yields. In this environment, small-cap stocks within the S&P 600 could present unique opportunities for investors seeking value in under-the-radar companies that may benefit from economic shifts. Identifying a good stock often involves considering factors such as strong fundamentals, innovative business models, and resilience in challenging market conditions—all of which can be crucial for uncovering undiscovered gems in today's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Elron Ventures | 5.70% | 13.72% | 25.56% | ★★★★☆☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Pure Cycle (PCYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pure Cycle Corporation operates in the United States, offering wholesale water and wastewater services, with a market capitalization of $265.30 million.

Operations: Revenue streams include land development ($14.93 million), single-family rental ($0.50 million), and water and wastewater resource development ($12.03 million).

Pure Cycle, a smaller player in the water utilities sector, shows potential with its price-to-earnings ratio at 19.5x, undercutting the industry average of 22.5x. Despite earnings declining by 2.3% annually over five years, recent performance tells a different story; earnings surged by 124.4% last year, outpacing industry growth of 16%. The company’s debt-to-equity ratio rose from zero to 5% over five years but remains manageable given its cash surplus over total debt. Recent buybacks saw Pure Cycle repurchase shares worth US$0.92 million, hinting at confidence in future prospects despite current challenges like negative free cash flow.

- Take a closer look at Pure Cycle's potential here in our health report.

Gain insights into Pure Cycle's historical performance by reviewing our past performance report.

Climb Global Solutions (CLMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Climb Global Solutions, Inc. is a value-added IT distribution and solutions company operating in the United States, Canada, Europe, and the United Kingdom with a market cap of $582.79 million.

Operations: Climb Global Solutions generates revenue primarily from its Distribution segment, contributing $552.45 million, and a smaller portion from its Solutions segment at $25.99 million.

Climb Global Solutions, a nimble player in IT distribution, has shown impressive growth with earnings jumping 61.2% over the past year, outpacing the electronic industry's -1.8%. Its debt to equity ratio has edged up to 0.5% from zero over five years, yet it maintains more cash than total debt, ensuring financial stability. Trading at 30.4% below its estimated fair value and boasting high-quality past earnings, Climb is poised for further expansion through strategic acquisitions and operational efficiencies as highlighted by their recent ERP implementation and focus on international markets like Europe and Canada.

Yuanbao (YB)

Simply Wall St Value Rating: ★★★★★★

Overview: Yuanbao Inc. operates through its subsidiaries to offer online insurance distribution and services in the People’s Republic of China, with a market cap of approximately $1.10 billion.

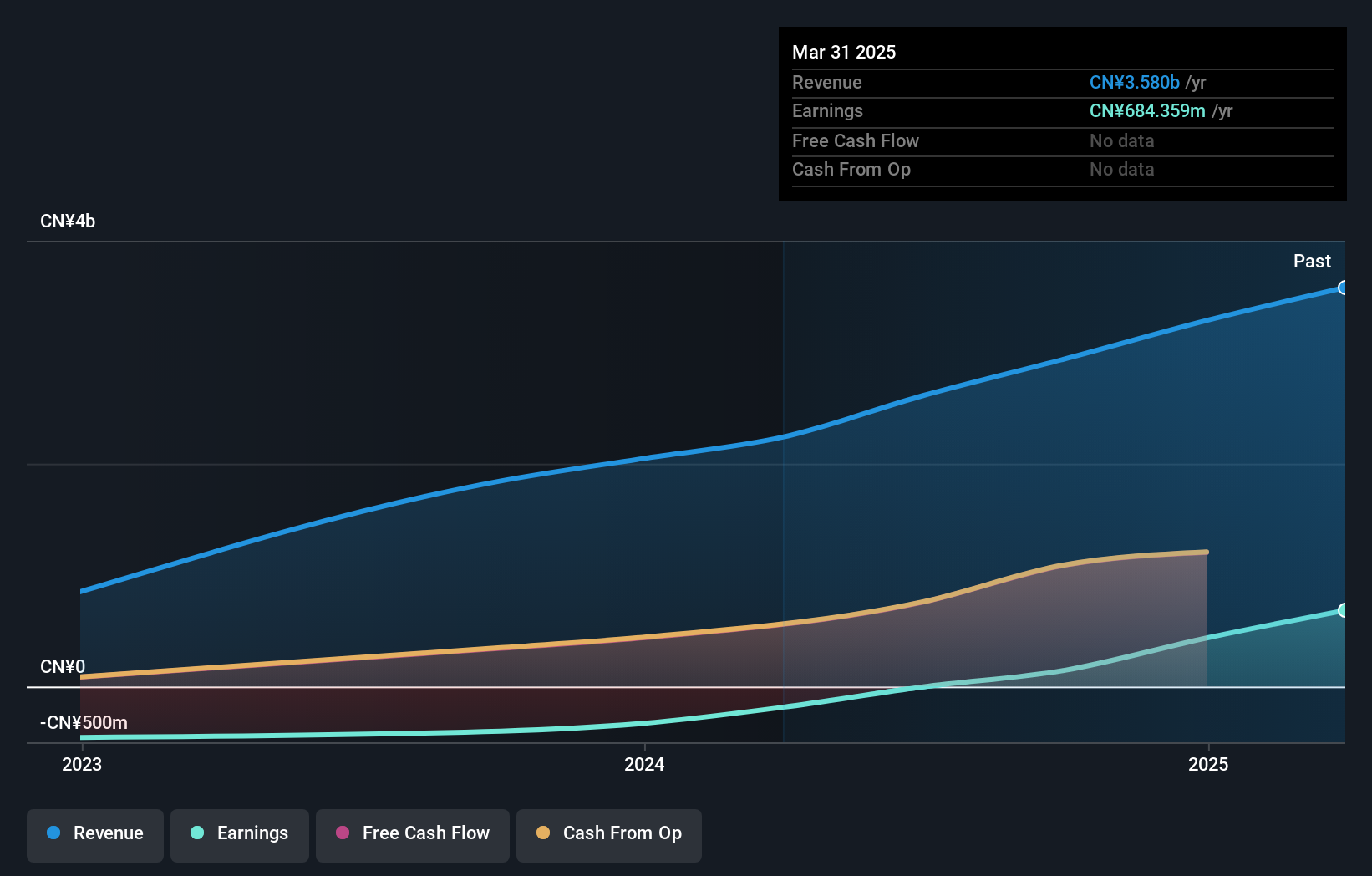

Operations: Yuanbao generates revenue primarily from its insurance brokers segment, totaling CN¥3.80 billion.

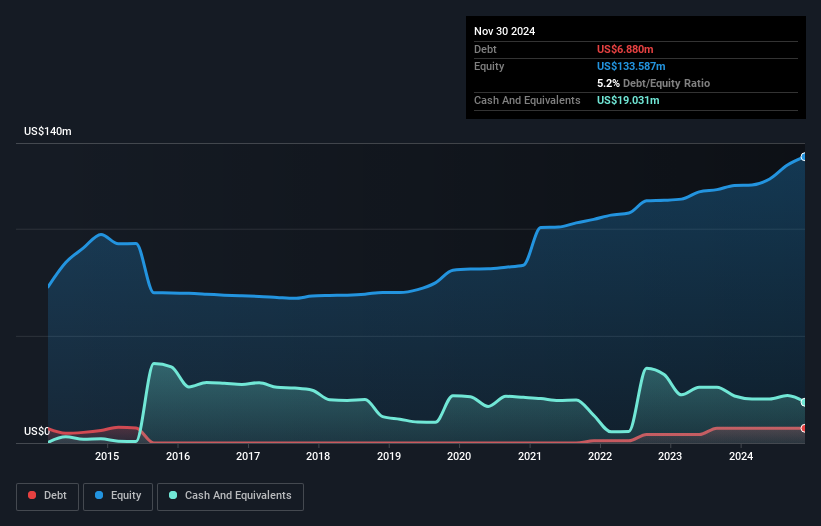

Yuanbao's recent performance paints a promising picture, with the company achieving profitability this year and reporting high-quality earnings. The firm is debt-free, eliminating concerns about interest coverage. Its sales for Q2 2025 reached CNY 1,069.93 million, up from CNY 854.46 million last year, while net income rose to CNY 304.69 million from CNY 195.86 million a year ago. Despite its volatile share price over the past three months, Yuanbao offers good value by trading at roughly 75% below its estimated fair value and has positive free cash flow of US$1.20 billion as of December 2024.

- Navigate through the intricacies of Yuanbao with our comprehensive health report here.

Examine Yuanbao's past performance report to understand how it has performed in the past.

Key Takeaways

- Explore the 285 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:YB

Yuanbao

Through its subsidiaries, provides online insurance distribution and services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives